Cодержание статьи

At the beginning of each year, many entrepreneurs engaged in e-commerce in the United States face the issue of reporting for company owners (particularly, LLC-Disregarded Entity).

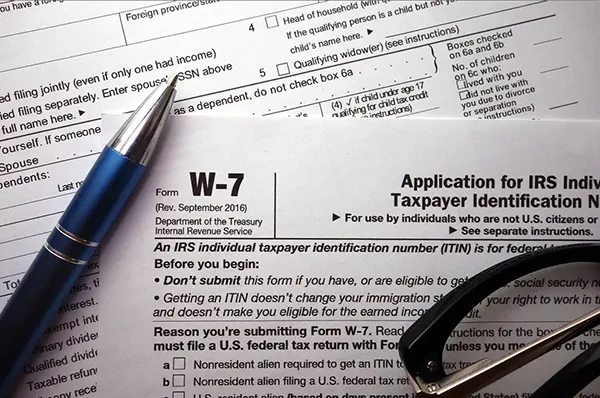

Not everyone knows that non-residents of the United States, when filing an annual personal income report (not corporate), need a tax identification number — ITIN (analogous to SSN, issued to non-citizens and non-residents of the United States).

ITIN (Individual Taxpayer Identification Number) is a number used for tax purposes, issued by the United States Internal Revenue Service (IRS).

It should be noted that non-residents cannot obtain a Social Security Number (SSN) in the United States, and the tax service provides a solution to this situation with the help of ITIN.

How does ITIN differ from EIN, and for what purposes is it used?

EIN (Employer Identification Number - Federal Taxpayer Identification Number) is used to identify companies with tax authorities, banks, and other organizations.

EIN is registered with the United States Federal Tax Service for companies but can also be assigned to self-employed individuals. However, ITIN is still required for reporting. Therefore, obtaining an EIN does not play a key role in filing an annual tax return for a self-employed person.

Importantly, EIN is issued by the federal service and does not depend on the state of company registration.

ITIN can be compared to the TIN (Tax Identification Number for individuals in CIS countries). The main purpose of this number is personal tax reporting.

Obtaining an ITIN is not difficult even for foreign citizens - non-residents of the United States who have a business in the States (which is the basis for obtaining it) but do not live there.

If you have an LLC in the United States (and have not chosen the taxation type as a corporation, Form 8832) and successfully sell on Amazon or other marketplaces, then at the beginning of the year, you are required to file a tax return with the IRS for the previous calendar year. All financial transactions related to an LLC Disregarded Entity are directly credited to its members (the LLC is not taxed as a separate structure). In this case, all income falls into the personal declarations of the founders, and the individuals - company owners - need to report. For this, ITIN is required.

Also, if you have an LLC with C-Corp taxation (and you have made a request using Form 8832) or you have a corporation, your company is required to pay a 21% federal income tax (as of the publication date of this article). For the previous tax period, you can report using EIN, as this type of company is a taxable structure. If there are remaining funds in the company after paying corporate tax and shareholders want to withdraw them as dividends, then the shareholders are required to file personal annual declarations. For this, ITIN or SSN is necessary.

IMPORTANT! Regardless of the company's form (LLC or Corporation) and the type of taxation (Disregarded Entity or C-Corp), receiving income from the company's activities in the States, an individual is required to report to the US tax service.

If you understand that it is necessary to obtain an ITIN, we advise you to contact a СРА (Certified Public Accountant in the United States). It is important to note that in 95% of cases, to obtain this number, you need to provide the original passport or a notarized copy of it. There are "Accepted CPAs" who have the right to process an ITIN without providing original documents.

If you need to obtain an ITIN or set up a company in the United States, our accredited specialists can assist you with the process. Please write us for more details on Telegram.

FAQ

How do I find out my TIN?

If seven weeks have passed since you applied for an Individual Taxpayer Identification Number (ITIN) or other correspondence and you have not received a response, you can call the IRS toll-free at 1-800-829-1040 (domestic calls only) to find out the status of your application. For assistance in Spanish, call +1-800-829-1040. For all other languages, call +1-833-553-9895.

What is an SSN in America?

In order to get a job in the United States, you must have a Social Security Number (SSN). Your SSN is used to track your earnings and determine your eligibility for Social Security benefits and certain government services.

What is a TIN called in America?

A Taxpayer Identification Number (TIN) is a number used by the U.S. Internal Revenue Service (IRS) to identify taxpayers. This number can match either your Employer Identification Number (EIN) if you are a business or employer, or your Social Security Number (SSN) if you are an individual.

How much Taxes in the USA?

In the United States, the sales tax rate depends on each state and can range from 0% to 11.50%. Each state also independently determines the list of goods and services that are exempt from sales tax.